The dealer-manufacturer relationship needs to be modernized. Like many aspects of the industrial economy, hundred-year-old systems for delivering customer value need to be recast for the modern era.

Outsourcing Sales and Service

The dealer model was largely pioneered by the auto industry, starting in 1898, and has been replicated in many ways since then. Manufacturers, increasingly specialized in production, sought alternate ways to sell. It became clear that selling cars directly, by mail order, or through traveling salesmen wouldn’t scale. A model emerged whereby a network of aligned, independently-owned franchises which would sell one maker’s cars.

Creating independent franchises and dealership channels became a convenient way to essentially outsource sales. Manufacturers could focus on efficient production and mitigate risk. They could achieve growth through independent dealers that were already on the ground, closer to customers, and focused on selling.

Over time, a global supply chain and technological advancement increased competition and price pressure. Margins on products became thinner, and dealers began to focus on services. New products were still a driver, but they sometimes lost money on the initial sale. Dealers found opportunities in service repairs and warranty claims, as well as used vehicles and auto auctions.

In the built environments industry, many furniture manufacturers created dealer-based sales channels during its early explosive growth era in the 1960s and 1970s. Like the automotive industry, dealerships were first based on product sales but shifted to services over time.

New Customer Relationships

Furniture dealers have felt many of the pressures by auto dealers. Aligned dealers initially built their brands based on manufacturer's products, since product brands were initially the main sales driver, and manufacturers have aimed to own the marketing message. Manufacturers invest in brand-building, and because manufacturers are typically larger and have more resources than any single dealership, dealers are beholden to manufacturers. On the other hand, manufacturers are dependent on dealers for sales, and they don’t completely own the sales channel. All this creates tension between dealers and manufacturers.

What’s more, the landscape has changed. In 2001, Apple famously made an aggressive move to vertically integrate its sales channel. They cut off its retailers and invested heavily in owned Apple Stores. So long, CompUSA and Circuit City! Apple was by no means the other manufacturer in these computer supply stores, and it was a big bet that paid off. It was a canary in a coal mine for makers and distributors alike. Many strive to replicate Apple’s direct-to-customer success, including Microsoft. Tesla, the Apple-like auto manufacturer, has followed suit by owning its own car stores.

Business furniture is different than computers or cars, but there are parallels. In a mature market like commercial furniture, product features and pricing cycles have hardened. Customer access to information via the internet has changed everything.

In the past, both furniture and auto dealers have had a high rate of employee turnover. In fact, sometimes car salespeople and furniture salespeople have been interchangeable – which is to say, they are not experts. By contrast, Apple Stores feature a Genius Bar, presumably staffed by knowledgeable people.

Aside from Tesla’s experiment, so far, automakers haven’t taken big steps toward Apple-like stores. As with the furniture industry, dealer relationships are deeply rooted and would be harder to unbundle. For auto dealer innovation, consider CarMax.

Founded in 1993, CarMax is the largest used-car retailer in the U.S. and a Fortune 500 company. Unlike the roots of independent dealerships having relationships with large manufacturers, CarMax has taken a “big box” mentality to the dealership model. CarMax dealers are linked together, yielding network benefits including greater scale, access to inventory and better selection. Salespeople are paid on a commission per car, so there is no-haggle pricing. CarMax will buy any car on the spot after a short appraisal, regardless of whether or not the seller intends to buy a car at CarMax. In short, CarMax aims to make it easier to buy a car by removing customer pain.

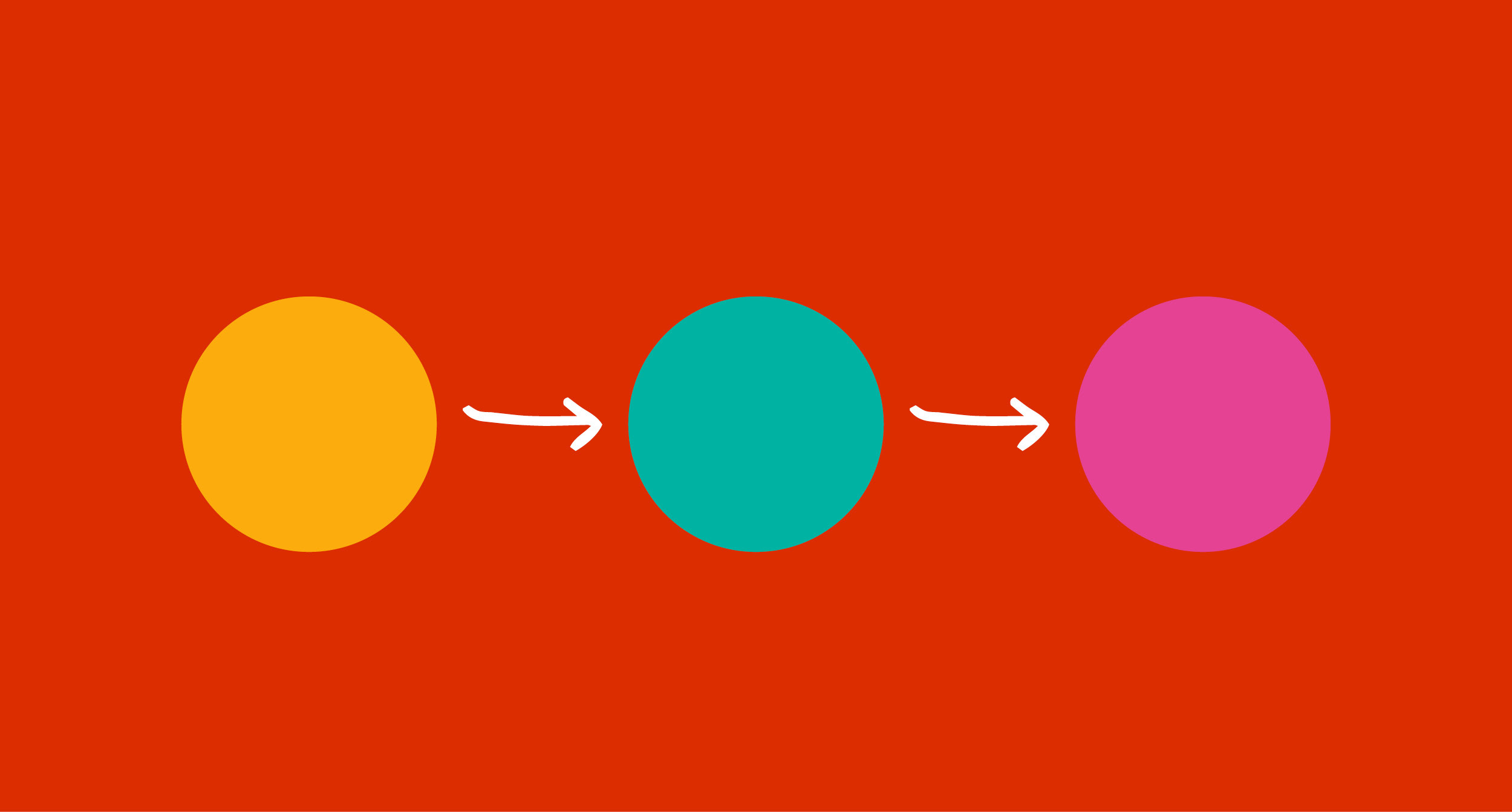

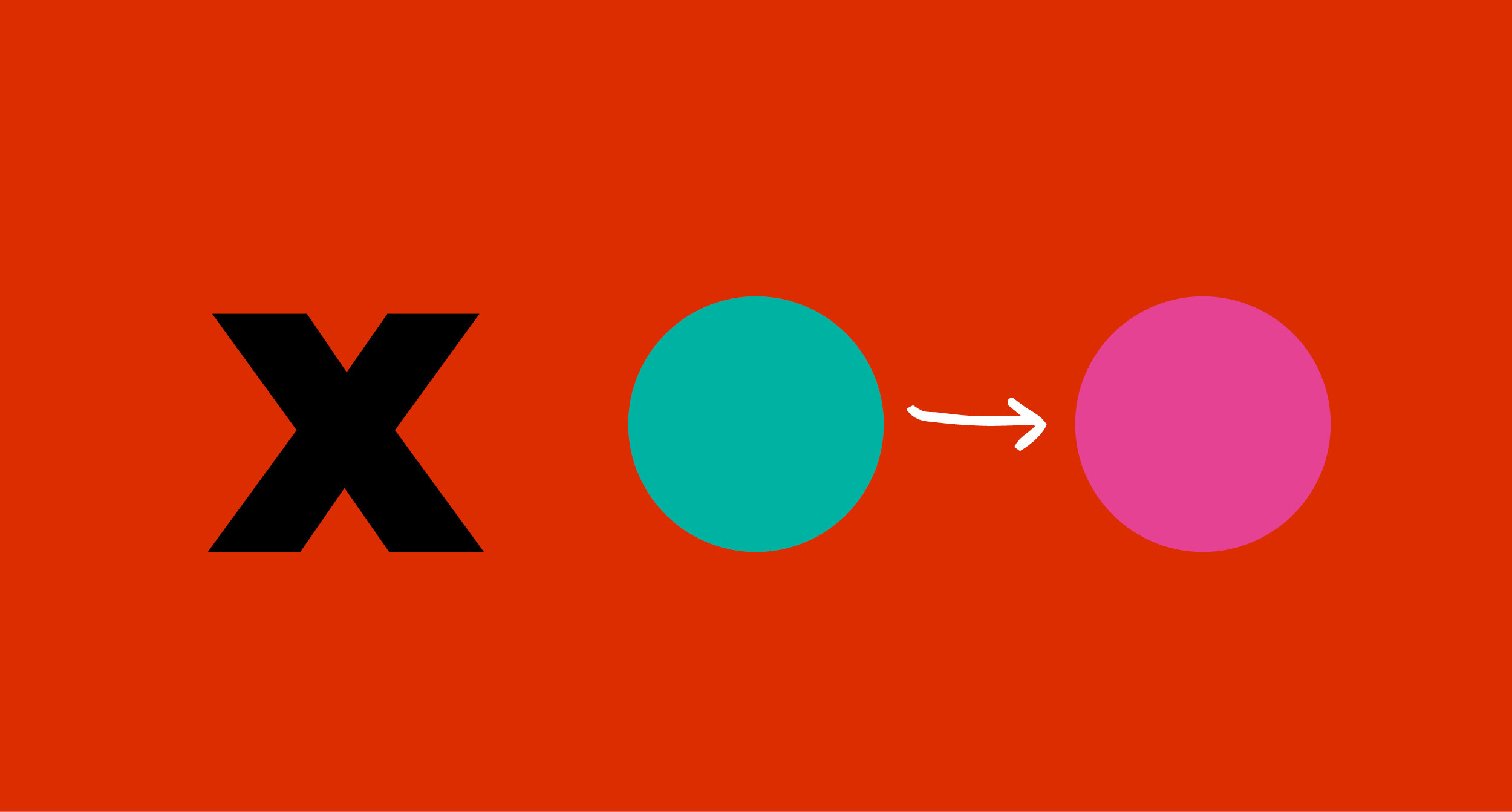

Aside from its impressive sales growth, it is instructive to note how CarMax views itself through its Annual Reports. The cover of its 2017 report featured these words: Integrity, Value, Selection, and Customer Service. No mention of car brands. The 2018 cover highlighted their expectation of how customers buy today: Mobile phone > Desktop > Showroom > Person.

Better Customer Experiences

Furniture makers and dealers should take note. In the case of both Apple Stores and CarMax, the emphasis was on meaningful customer experiences – not products per se.

The contract furniture market is rife with confused selling procedures that can feel like buying a computer at CompUSA. Customers who are not industry veterans may wonder why things are so complicated. It’s not a distributor, it’s a dealer. No, not a dealer, a rep. Not an individual sales representative, a rep group. Not a rep, a manufacturer salesperson. Shall we discuss aligned vs open-line dealers? Let’s not even talk about A&D.

Dealer-based selling has to modernize. What started as a logical way to scale a hundred years ago has become a liability. Today, customers demand simpler, better experiences. Industry players have to consider all the pieces on the board, their functions, and connections. It could be that “dealer” is the wrong label - what is the connotation of a furniture dealer? What is the customer really trying to do? Are they looking to make a “deal” or solve a problem? What role are you going to play to help them achieve their goal? Here is a tip: The answer is not “furniture” – nor does it have anything to do with a business relationship between sellers and manufacturers.

Whether a manufacturer-driven solution like Apple Stores or a dealer-driven solution like CarMax, the answer is in an integrated whole and intentional brand experience. In case all this sounds like too much to ask, it’s helpful to note that business innovation is alive and well in many segments. After all, the entity behind the formation of CarMax was Circuit City.

In the information economy, quality products and delivery are table stakes. Yesterday, brands were products. Today, brands are meaningful customer experiences.